Understanding the Void and Reissue Process

How to void and reissue a pay cycle.

The void and reissue process is used when we need to correct an employee payroll record that affects the taxable wages of an employee for a current or prior quarter. Amendments are needed alongside a void in a prior quarter to report the adjusted wages to each respective agency impacted. Voids and reissues are used to correct:

-

Pre-Tax Deductions (Medical. Dental, Vision, 401k.)

-

Incorrect Pay Amounts

-

Employee coded to incorrect state and had taxes withheld.

-

Anything that impacts taxable wages for the employee

-

FICA incorrectly exempt or non-exempt for 1+ pay periods in a current quarter

HOW TO PROCESS A VOID AND REVERSAL

A void is when we remove an entire payroll record/check from Namely Payroll for an employee. A void removes the wages, taxes, and deductions from the system as if they never occurred.

If you notice an issue with an employee’s pay, you’ll be able to process a void to correct it by following these steps:

-

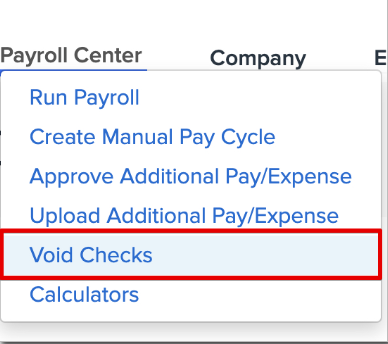

Click Void Checks from the Payroll Center menu in Namely Payroll.

-

Alternatively, scroll to the bottom of the Payroll Center and click Void Checks in the Payroll Voids section.

-

-

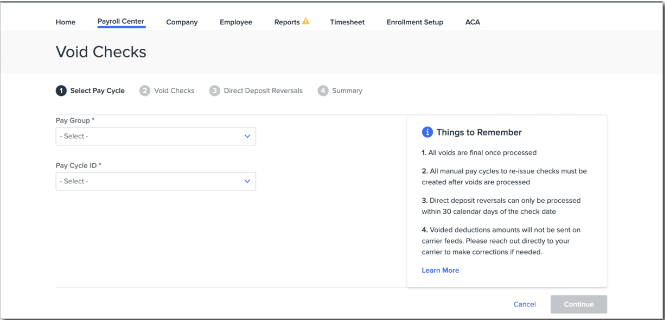

Select the Pay Group and Pay Cycle ID containing the payments you’d like to void and click Continue.

-

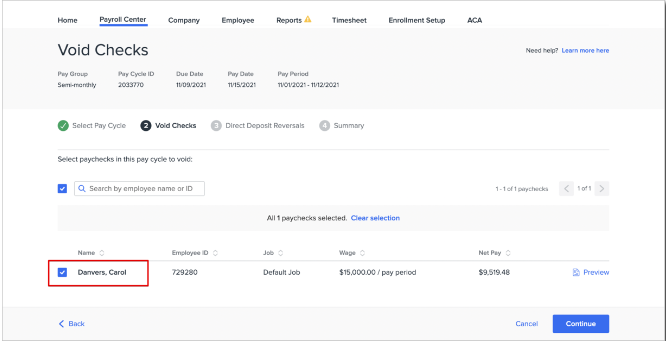

Select the employee checks you’d like to void and click Continue. You can review an employee’s paycheck by clicking Preview to confirm you’re taking action on the correct check.

-

You can check the checkbox next to the employee search field to select all employees within the pay cycle.

-

-

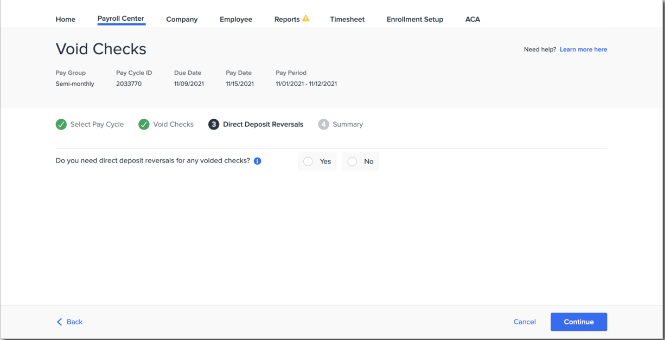

Confirm whether you need a direct deposit reversal and click Continue.

-

If you select Yes, you’ll be prompted to select the checks requiring a reversal.

-

Reversals require a reason. You’ll need to select one of the below reasons to process your reversal:

-

Duplicate Deposit

-

Deposit to Incorrect Account

-

Incorrect Account Deposited.

-

-

Next, click Continue to review a summary of your proposed voids and reversals.

-

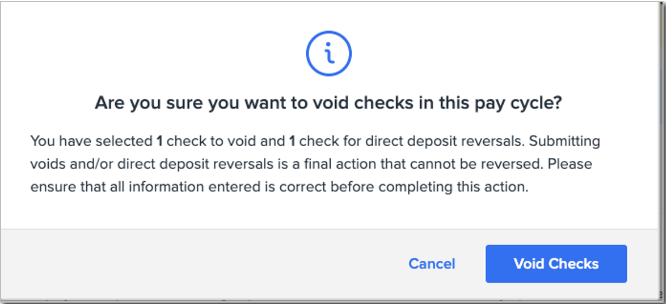

Voids cannot be reversed once processed. The system will ask you to confirm that you want to proceed with the voids and reversals noted. Click Void Checks if you’d like to process your voids.

TIP:

To void prior quarter checks, checks from your final pay cycle in the current quarter, or any current quarter checks when there are no more standard pay cycles in the current quarter submit a case in the Help Community and attach the filled out request form below. Select Payroll as the product you need assistance with and Corrections from the list of issues.

Negative amounts related to voids will not be sent over on retirement or other file feeds. You will need to contact your carrier(s) directly to ensure the void is updated in their system.

Request Form

Note: This form can be filled out electronically in Adobe Acrobat. If you need to manually fill out the form, print a copy and scan the completed form prior to your case submission.

Download PDF Here: Void Form_2022.pdf

REISSUE

A reissue is necessary after a void to ensure the employee’s payroll history is updated. It is your responsibility to process the reissue after the void in Namely Payroll by following the steps below:

-

Log into Namely Payroll.

-

Go to the Payroll Center.

-

Click CreateManualPay Cycle and choose the appropriate check date. The check date should be the same date as the void you just completed.

-

Run Payroll and review the information to ensure pay is accurate. If it is accurate, click Save.

-

In Step 2 of Payroll Processing click Global Payroll Update and select Disable Direct Deposits to ensure the employee doesn’t receive payment. Block Namely Checks, if necessary.

-

Click Save.

-

Click CalculatePayroll.

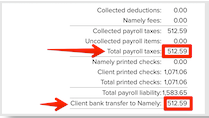

Ensure that the following is reflected in the Payroll Summary or Cash Requirement Report:

Namely printed checks: should be $0.00

Direct Deposit net pay: should be $0.00

Client printed checked: net pay total

TIP:

The Client Bank Transfer to Namely and Total Payroll Tax amount should be identical if the reissue has been done correctly.

If your employee is owed money you can reimburse on a future pay cycle using pay code Reimbursement Non-Taxable. If an amount is due from the employee, you can work with the employee to recoup the funds directly.

WHEN A VOID AND REISSUE IS NEEDED

-

Pre-Tax Deductions (Medical. Dental, Vision, 401k etc)

-

Employee was overpaid

-

Employee taxed in the wrong state

-

FICA incorrectly exempt or non-exempt for 1+ pay periods in a current quarter

WHEN A VOID AND REISSUE IS NOT NEEDED

-

Post-tax deduction

-

Employer Amount needs to be adjusted

-

Employee paid using incorrect pay code (same taxation).

-

For example, moving “Bonus” to “Commission” or “Bonus (W4)” to “Commission (W4).

-